Lower priced Affordable health insurance: Your whole manual to coverage without Breaking the bank

Table of Contents

1. Advent: Why low-cost medical insurance matters

2.expertise medical insurance basics

3. Elements That have an effect on health insurance fees

4. A way to find low cost medical health insurance

knowledgeable alternatives.

5.Take advantage of Subsidies and discounts

6. Expertise medical medical health insurance Terminology

7. Commonplace

8. Real-existence Examples of low-priced medical insurance Plans

9. Regularly asked questions about affordable health insurance

10. Conclusion: Taking manage of Your fitness coverage

1. Advent: Why low-cost medical insurance matters

Medical health insurance is not just a safety internet—it’s a lifeline. It ensures that you could get entry to hospital therapy while you need it without draining your savings or plunging into debt. But let’s face it, navigating the sector of health insurance may be complicated and regularly steeply-priced. The coolest information? Lower priced options do exist, and know-how how to locate them is the first step toward securing your fitness and financial well-being.

Expertise Affordable health insurance basics

Health insurance is an essential issue of current existence, supplying monetary safety towards the excessive fees of hospital treatment. It’s far from a contract among an individual and a coverage agency, in which the man or woman will pay charges in trade for coverage of scientific prices, which includes health practitioner visits, sanatorium remains, medicines, and preventive care. Information about the basics of medical insurance is crucial to make informed selections about policies and ensure adequate safety for yourself and your circle of relatives.

How medical health insurance Works

Medical health insurance operates on the precept of danger pooling, where charges from many people are amassed to create a fund that covers the medical charges of folks that need care. This shared hazard guarantees that individuals are not solely answerable for exorbitant scientific payments. Guidelines commonly encompass numerous key elements:

1. Premiums are monthly or annual payments made to the insurer to hold coverage.

2. Deductibles: The amount you ought to pay out-of-pocket earlier than insurance begins covering charges.

3.Copayments and Coinsurance: Those are the shared expenses among you and the insurer, with copayments being a hard and fast quantity (e.G., $20 for a health practitioner’s visit) and coinsurance being a percentage of the total value.

4.Out-of-Pocket Maximums: The restriction on how much you pay in a yr before the insurance covers one hundred% of eligible fees.

Information in those phrases is critical to selecting the proper plan and handling clinical prices efficiently.

Forms of medical health insurance Plans

There are numerous types of medical health insurance plans, every with particular functions tailored to exclusive needs.

– Fitness renovation companies (HMOs): Those plans require individuals to pick out a primary care doctor (PCP) and gain referrals for specialist care. They emphasize preventive services and generally have decreased rates and out-of-pocket fees.

– Desired company groups (PPOs): PPOs provide extra flexibility in choosing healthcare carriers, such as experts, while not having referrals. But, they often come with higher rates and out-of-pocket costs.

-Different provider businesses (EPOs): EPOs integrate functions of HMOs and PPOs, requiring you to apply a network of docs and hospitals while imparting flexibility just like PPOs but without referrals.

– High-Deductible health Plans (HDHPs): Those plans have lower premiums and better deductibles, making them suitable for people who do not often use scientific offerings. They regularly pair with health savings debts (HSAs) for tax blessings.

Deciding on the proper plan relies upon your healthcare desires, economic situation, and desired degree of flexibility.

The significance of health insurance

Medical health insurance not handiest provides economic safety however also ensures admission to satisfactory care. Without it, even routine medical tactics can end up being financially overwhelming. Moreover, many regulations cover preventive offerings like vaccinations, screenings, and well-being visits, promoting long-time period fitness.

As an instance, a person with medical health insurance may additionally pay a fragment of the price for a main surgical operation, whilst an uninsured individual may want to face tens of hundreds of dollars in scientific payments. Furthermore, having coverage improves entry to well-timed care, decreasing the chance of complications from untreated situations.

Navigating the Enrollment technique

Knowledge of the enrollment manner is crucial to securing insurance. By carefully comparing these factors, you can select a plan that aligns with your desires.

Not unusual demanding situations in knowledge health insurance

In spite of its significance, medical health insurance can be perplexing. Many human beings struggle to recognize technical jargon, policy obstacles, or the claims’ system. Misinterpreting coverage details can result in surprising prices.

For instance, failing to understand the difference among in-network and out-of-community providers can result in substantially higher scientific bills. Moreover, rules frequently have exclusions or waiting periods for unique remedies, which could capture individuals off shield.

3. Elements That have an effect on health insurance fees

Health insurance is a cornerstone of financial safety, however the value can vary significantly relying on numerous elements. Information about these factors is important for making knowledgeable selections about insurance and managing healthcare fees correctly. Beneath, we will discover the primary participants to medical insurance charges and delve into subcategories to offer a clearer photo.

1. Age and fitness circumstance

One of the most influential factors in determining health insurance premiums is a person’s age. More youthful individuals generally pay decreased premiums because they are generally more healthy and less likely to want vast hospital treatment. Conversely, older individuals may additionally face better premiums because of improved dangers of chronic illnesses and scientific situations.

Health circumstance also plays a critical function. Insurers examine pre-existing conditions, family clinical history, and typical fitness status. Human beings with continual illnesses like diabetes, heart conditions, or bronchial asthma often face higher premiums as insurers count on more scientific fees.

2. Life-style and behavior

Private lifestyle choices and conduct appreciably have an effect on health insurance fees. For instance, people who smoke and people with a record of alcohol or substance abuse commonly pay higher premiums. That is because those habits are associated with a better probability of growing severe health issues, growing the insurer’s monetary chance.

In contrast, maintaining a healthy way of life, which includes normal exercise and a balanced food plan, can assist decrease coverage costs. Some insurers even provide well-being packages or reductions for people who display healthier residing practices.

3. The area and residency

In which you stay can also affect your medical health insurance rates. Insurance expenses frequently vary by kingdom, place, or even zip code, depending on neighborhood healthcare costs, the availability of scientific centers, and kingdom regulations. For example, individuals dwelling in urban areas with better healthcare company expenses might pay extra than those in rural regions.

Additionally, states with increased Medicaid applications or sturdy healthcare subsidies may additionally offer extra low-priced insurance alternatives, reducing the out-of-pocket burden for residents.

4. Sort of coverage and Plan choice

The form of health insurance plan you pick is every other essential element. Plans with broader coverage options, which include decreasing deductibles and access to a much wider community of healthcare providers, usually have better rates. Conversely, excessive-deductible health plans (HDHPs) frequently include decrease charges but require people to pay extra out-of-pocket earlier than insurance coverage kicks in.

Extra advantages like dental, vision, or maternity coverage can also boom costs. Opting for a primary plan without these extras may lower premiums however might not meet all healthcare desires.

5. Employer Contributions and group Plans

For the ones insured through their organization, the fee of medical insurance is often motivated through the business enterprise’s contribution. Many employers subsidize a part of the premiums, making medical insurance extra low-cost for employees. Organization plans, commonly offered by employers, tend to be much less high-priced according to man or woman compared to personal coverage due to the fact the threat is unfolded across a larger pool of human beings.

Self-hired individuals or freelancers, but, can also face higher rates due to the fact they undergo the full cost of insurance themselves.

6 Own family size and Dependents

The quantity of humans covered beneath a single medical health insurance policy immediately impacts the fee. Rules that include dependents, along with kids or a spouse, usually include higher charges compared to person coverage. Every extra character will increase the insurer’s risk and capacity expenses.

Some insurers offer their own family plans with tiered pricing based totally at the quantity of dependents, which can be a greater price-effective choice for larger households.

7. Policy functions and Deductibles

Medical insurance regulations include various features, along with copayments, coinsurance, and annual deductibles. Better deductibles typically result in lower rates, even as decrease deductibles suggest higher rates. In addition, guidelines with better out-of-pocket limits may additionally offer lower monthly rates, but individuals must be prepared to pay extra for healthcare offerings till the out-of-pocket maximum is met.

8 Monetary elements and rules

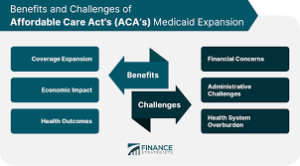

Broader monetary and political factors also have an impact on medical health insurance costs. Inflation in healthcare services, changes in authorities subsidies, and new rules can affect premium quotes. As an example, the lower priced Care Act (ACA) brought subsidies and mandates that aimed to make coverage available however also encouraged charges through coverage necessities.

Monetary downturns or rising healthcare generation charges can cause top rate increases, even as competitive markets and regulatory interventions may help lower costs in a few cases.

4.A way to find low cost medical health insurance

Medical health insurance is a critical factor of economic planning, but many individuals war with its excessive prices. Know-how the way to navigate the landscape of medical insurance can make a significant difference in locating a lower priced plan that meets your desires. Below, we break down techniques and tips for securing less costly health insurance.

Check Your fitness desires

Step one in finding affordable medical insurance is to assess your non-public and own family fitness necessities. Recall elements along with the frequency of medical visits, present fitness conditions, required medicines, and any anticipated processes. By way of expertise your healthcare needs, you could keep away from deciding to buy useless insurance and cognizance of what is crucial.

2. Pick excessive-Deductible fitness Plans (HDHPs)

In case you are commonly healthful and do no longer count on commonplace scientific visits, consider enrolling in an excessive-deductible fitness plan (HDHP). Those plans usually have lower monthly costs, making them an outstanding preference for people trying to shop on prematurely fees. Moreover, HDHPs are frequently paired with health monetary financial savings debts (HSAs), which let you maintain pre-tax coins for medical charges, further decreasing your conventional healthcare expenses.

3. Employ Preventive Care offerings

Many health insurance plans offer free preventive care offerings, which include vaccinations, screenings, and annual check-ups. Regularly using the ones services can assist encounter functionality health issues early, reducing the opportunity of highly-priced treatments in the future. Prioritize your health through the usage of scheduling normal check-u.S. Of America and staying up to date on preventive measures, as it may bring about extended-term financial monetary financial savings on scientific fees.

4. Hold within the route of Open Enrollment intervals

The open enrollment period is the right time to relook at your medical medical health insurance dreams and find out new plans. Corporations regularly replace their services, which may additionally embody price-saving alternatives. If your cutting-edge plan does not suit your price variety or manner of life, switching inside the route this time can save you cash. Maintain an eye on deadlines and prepare in advance to make knowledgeable alternatives.

5.Take advantage of Subsidies and discounts

Counting on your profits degree, you could qualify for government subsidies or discounts in your medical health insurance premiums. Packages like Medicaid or pinnacle charge tax credit score underneath the cheap Care Act (ACA) are designed to make coverage more cheap. Check your eligibility and observe for assistance to noticeably lessen your insurance prices.

6. Leverage organization blessings

If your agency offers medical insurance, evaluation the to be had plans and any additional benefits which incorporate fitness packages or flexible spending debts (FSAs). Business enterprise-sponsored insurance is frequently greater low-fee because of organization discounts. Taking part in place of work properly being responsibilities may additionally earn you pinnacle elegance reductions or incentives.

7. Negotiate scientific bills

In case you get the preservation of a clinical bill that seems high, don’t hesitate to negotiate collectively, collectively together with your healthcare enterprise. Hospitals and clinics may offer reductions or price plans, particularly in case you are uninsured or have an immoderate-deductible plan. Discussing your financial state of affairs earlier can cause tremendous financial savings.

8. Undertake an extra wholesome manner of life

Prevention is better than treatment, and a greater way of life can right now lower your healthcare expenses. Through keeping a balanced food regimen, exercising regularly, and retaining unstable conduct like smoking, you reduce your risk of persistent illnesses. Insurers can also furthermore even offer discounts to policyholders who showcase wholesome dwelling behavior, further decreasing your charges.

9. Use common medicines

While prescribed treatment, ask your clinical health practitioner if a commonplace version is to be had. Common pills are commonly a good buy cheaper than emblem-call equivalents however are simply as effective. Many clinical health insurance plans offer higher insurance for generics, primarily to lower out-of-pocket prices.

10. Package coverage guidelines

In case you require more than one variety of coverage, together with health, dental, and vision, undergo bundling them with the same corporation. Bundling guidelines often qualify for discounts, allowing you to shop on costs during the board. It is a smooth yet powerful manner to lessen commonplace coverage fees.

6. Expertise medical medical health insurance Terminology

Navigating the world of clinical health insurance can often be like deciphering a distant places’ language. Complicated terminology and enterprise-specific jargon may additionally want to make understanding your insurance and making informed alternatives difficult. Familiarizing yourself with commonplace clinical health insurance terms is vital for successfully managing your healthcare charges and making sure you are utilizing your benefits genuinely. Permit’s damage down some key health insurance terminology that will help you preserve near its nuances.

Pinnacle rate: The fee of insurance

The pinnacle of elegance is the quantity you pay, typically monthly, to hold your scientific medical health insurance insurance. Remember it because the membership rate provides you with entry to the insurance. This charge is needed irrespective of whether or no longer or no longer you operate your health advantages. As an example, in case your monthly pinnacle class is $two hundred, you will owe this amount even in months whilst you do not visit the doctor or make any insurance claims. Records of your top class are vital even as budgeting for medical health insurance and choosing a plan that aligns together with your economic situation.

Deductible: Your initial responsibility

The deductible is the personal sum you ought to pay for covered medical care administrations ahead of time than your inclusion begins to make a commitment. As an occurrence, on the off chance that your arrangement has a $1,000 deductible, you’ll have to pay this amount for clinical charges sooner than your inclusion starts off evolved overlaying a level of the expenses. Exorbitant deductible plans regularly comprise lower expenses, making them alluring to people who anticipate negligible clinical charges. On the turn issue, low-deductible plans is probably higher for people with ongoing scientific dreams.

Copayment and Coinsurance: Sharing expenses

At the point when you’ve met your deductible, you’ll no doubt experience terms like copayment (copay) and coinsurance.A copay is a limited sum you pay for explicit commitments, which embody $30 for an expert’s go to or $10 for a cure. Coinsurance, however, is a percent of the charge which you percentage collectively with your insurer. For example, in case your coinsurance rate is 20% and a systematic invoice amounts to $1,000, you will pay $ hundred at the same time as your coverage covers the rest. Those shared costs are part of how coverage agencies stabilize their danger.

Out-of-Pocket most: Your safety internet

The personal most is a cap on how much you will ought to pay out of your pocket for shrouded contributions in a given 365 days. After you accomplish this limitation, your inclusion covers 100 percent of qualified charges. As an example, in case your plan’s out-of-pocket most is $5,000 and also you’ve paid that amount in deductibles, copays, and coinsurance, your insurer will manage all subsequent prices for protected offerings that one year. This guard can provide sizable financial comfort, particularly in case of crucial fitness activities.

Community vendors: In-community vs. Out-of-community

Medical insurance plans commonly have networks of favored vendors, which encompass clinical medical medical doctors, hospitals, and experts which have agreements with the insurer. Traveling in-community organizations commonly ensures lower charges in view that they have negotiated expenses along with your insurer. Out-of-community vendors, as an alternative, may additionally furthermore result in better costs or perhaps no insurance, depending on your plan. Being privy to your network let you keep away from surprising payments and make knowledgeable picks approximately your care.

Explanation of advantages (EOB): interpreting the bill

An evidence of blessings is a document you get kept after a healthcare company is processed through using your insurance. It outlines what was modified into billed, what your insurer paid, and what element you owe. Although it is no longer an invoice, the EOB is crucial for verifying those prices are correct and to assess your monetary duty. Reviewing this file cautiously will let you spot errors or discrepancies.

Open Enrollment length: Your Window to choose

The open enrollment duration is the right time each 365 days whilst you can be a part of or make changes in your scientific medical health insurance plan. Missing this window is a normal method prepared till the subsequent enrollment period, until you qualify for a unique enrollment because of life activities like marriage, childbirth, or task loss. Knowledge whilst open enrollment takes area guarantees you do not bypass over the opportunity to secure or replace your insurance.

7. Commonplace

Myths approximately low-charge scientific health insurance is one of the maximum essential components of financial safety and well-being. But, the hassle often gets clouded through misconceptions, particularly in phrases of much less luxurious options. The ones myths can discourage humans and families from exploring suitable plans, leaving them susceptible to immoderate medical expenses. Permits unpack a number of the most pervasive myths about low cost medical health insurance, revealing the truth in the back of them and empowering you to make knowledgeable picks.

Myth 1: less luxurious medical medical health insurance method horrible coverage

Many receive as actual with that lower-price scientific medical insurance plans provide subpar coverage, leaving policyholders exposed to large scientific charges. But that is a way from the truth. Less expensive coverage options, collectively with those furnished underneath government programs or through health insurance marketplaces, frequently offer complete advantages, which incorporate scientific medical doctor visits, hospitalization, prescription drugs, and preventive offerings. Plans categorized as “low-cost” are designed to balance rate and insurance, making sure crucial health desires are met without overwhelming financial pressure.

Subparagraph:

As an example, under the much less expensive Care Act (ACA), all marketplace plans need to cover ten critical health advantages, which incorporates emergency offerings, maternity care, and highbrow fitness remedy. Those rules make sure that even price range-great recommendations are robust and sufficient to guard policyholders from economic spoil during fitness emergencies.

Myth 2: business enterprise-sponsored insurance is continuously less high-priced

Some other commonplace false impression is that medical insurance furnished by means of the usage of the way of employers is continuously more much less expensive than man or woman plans. Even as organization-subsidized coverage can provide widespread benefits, alongside facet shared prices and organization costs, it is not universally much less high-priced. Counting on elements like circle of relatives length, profits degree, and private health goals, a man or woman or market plan may additionally offer better fees.

Subparagraph:

As an example, low-earning people may also qualify for subsidies or Medicaid coverage, which considerably reduce fees. Then again, business enterprise-subsidized plans can also have better expenses or limited insurance alternatives, making them less attractive for excellent families. Evaluating all to be had options is essential to finding the most cost-powerful plan.

Myth 3: greater youthful and healthy human beings do not need coverage

Teenagers often expect they do not need health insurance due to the truth they hardly ever get ill. At the same time as it is actual that greater, more youthful people can also have fewer medical desires, this does not cast off the danger of injuries, surprising illnesses, or persistent situations. Skipping coverage to preserve coins inside the quick term can backfire if an unexpected medical difficulty arises, principal to exorbitant out-of-pocket fees.

Subparagraph:

Affordable medical insurance plans tailor-made to young, healthful individuals, which include catastrophic plans, are designed to provide coverage for emergencies at a low premium. Those alternatives make certain peace of thoughts without straining your budget, proving that coverage is not only a protection internet for older adults.

Myth 4: low cost coverage Excludes specialist Care

Many human beings mistakenly agree that low-priced health insurance plans exclude specialist care or include a slender community of medical doctors. Actually, most fitness plans, regardless of cost, include getting entry to experts and networks of satisfactory carriers. But understanding how networks work is prime to keeping off unexpected fees.

Subparagraph:

Lower priced plans frequently come with clear pointers on in-community and out-of-network insurance. Through selecting in-network experts, policyholders can receive care without incurring significant extra expenses. Moreover, many plans allow for referrals to top-tier specialists, ensuring pleasant care when you want it.

Myth 5: Pre-existing situations aren’t blanketed

The concern of being denied coverage because of pre-existing situations has persevered for many years, no matter the enormous criminal reforms. The ACA prohibits insurance vendors from denying insurance or charging better charges primarily based on pre-present situations. This safety applies to all market plans, such as the maximum low-cost options.

Subparagraph:

For people with persistent ailments or lengthy-term health desires, this fable can be particularly unfavorable. Low-cost medical insurance plans no longer simplest cowl pre-present conditions however additionally provide sources for managing them efficiently, which include ordinary checkups and discounted medicinal drugs.

Myth 6: authorities Plans are not so good as private coverage

A few anticipate that government-backed packages like Medicaid or ACA market plans provide restrained, or substandard insurance compared to personal insurance. On the other hand, those programs are often life-saving for low-income families, supplying complete benefits at minimal price.

Subparagraph:

Medicaid, for instance, covers an extensive range of offerings, together with preventive care, clinic remains, or even lengthy-term care for eligible individuals. ACA marketplace plans, with their standardized important fitness advantages, ensure the best coverage that opponents personal plans.

Myth 7: lower priced Plans Have Hidden costs

It is a significant notion that cheap health insurance plans come with hidden fees or out-of-pocket surprises. While it is essential to read the first-class print, the ACA has delivered transparency measures to help clients apprehend their plan’s prices prematurely. Info like deductibles, copayments, and coinsurance are clearly outlined, ensuring that policyholders are not blindsided through surprising prices.

Subparagraph:

Furthermore, many low-priced plans cap annual out-of-pocket expenses, presenting a monetary safety net for major clinical events. Through expertise in those features, you can make knowledgeable choices and keep away from the pitfalls of hidden expenses.

8. Real-existence Examples of low-priced medical insurance Plans

Low-cost medical health insurance is not just a buzzword; It is a sensible necessity for millions of human beings worldwide. As healthcare charges maintain upward thrust, the demand for plans that stability complete coverage with affordability has grown drastically. Fortunately, there are various real-life examples of medical insurance plans that cater to diverse needs, whether you are a younger expert, an own family of 4, or a senior citizen on a fixed profit. Below, we explore some examples that highlight the functions, advantages, and affordability of such plans.

1. Medicaid: A Lifeline for Low-earnings families

Medicaid is one of the most famous examples of a low-priced health insurance application inside the United States of America. Designed for low-income people and households, it presents comprehensive insurance, together with physician visits, sanatorium stays, pharmaceuticals, or even lengthy-time period care in some cases. Eligibility is determined by using profits and varies by using state, making it a viable alternative for tens of millions of American citizens.

For example, a single mother earning beneath the federal poverty stage can access Medicaid while not having to pay premiums or deductibles. This ensures that important health offerings are available without including monetary pressure. In states which have multiplied Medicaid beneath the inexpensive Care Act (ACA), more people, including childless adults, have benefited from this low-value alternative.

2. ACA marketplace Plans: custom designed Affordability

The low-cost Care Act (ACA) marketplace gives a ramification of insurance plans tailored to one-of-a-kind profits stages and wishes. Many people and households qualify for subsidies, considerably lowering their month-to-month premiums. For example, a middle-profits circle of relatives of four incomes $60,000 yearly would possibly receive a subsidy that lowers their monthly premium to under $200, depending on the plan.

Bronze plans underneath the ACA are mainly inexpensive for individuals who prioritize low charges and are secure with higher out-of-pocket charges for infrequent care. However, Silver plans strike a stability among fee and insurance, with extra savings available through value-sharing reductions for eligible enrollees.

3. Organization-subsidized medical health insurance Plans

Corporation-sponsored medical insurance remains one of the most fee-powerful options for operating individuals and households. Many companies negotiate institution prices with coverage providers, permitting personnel to gain from decrease rates and comprehensive coverage.

Take, as an instance, a tech corporation employee paying $150 consistent with month for a man or woman plan that covers annual test-ups, preventive care, and prescribed drugs. Employers regularly make a contribution considerably to the premium value, making it an extra affordable choice than buying a similar plan independently.

4. Quick-term medical insurance Plans

Brief-time period medical health insurance plans are a practical solution for folks who are between jobs or anticipating other insurance to start. Even as these plans are not as complete as lengthy-time period options, they are considerably inexpensive and provide fundamental coverage for emergencies and surprising ailments.

As an example, a recent university graduate transitioning to their first activity may pay $50-$one hundred per month for a brief-time period plan that covers pressing care visits, hospitalization, and a few prescribed drugs. This guarantees they are covered without the financial burden of a full-fledged policy.

5. State-unique programs: revolutionary local answers

Many states have added specific medical insurance applications tailored to their citizens. For example, Massachusetts’ ConnectorCare software gives low-cost plans with minimal copayments and 0 deductibles for residents earning below three hundred% of the federal poverty stage.

In addition, in California, the Medi-Cal application extends less costly coverage to low-earnings people and households, with alternatives that consist of dental and vision care. These nation-particular packages are frequently greater low-priced than federal options and cater to localized healthcare needs.

6 Fitness-Sharing Ministries: A network technique

Health-sharing ministries provide an unconventional however an increasing number of popular opportunities to traditional medical health insurance. Individuals of these applications pool their assets to cover each different medical costs, often at a fragment of the cost of popular coverage.

As an example, a circle of relatives collaborating in a fitness-sharing ministry may pay $500 consistent with monthly insurance that consists of maternity care, surgeries, and preventive offerings. Whilst these packages are not coverage in the traditional feel and may have barriers, they offer an inexpensive alternative for those aligned with their standards.

7. Medicare benefit Plans: budget-pleasant options for Seniors

For seniors, Medicare advantage plans (element C) offer a fee-powerful manner to get entry to complete healthcare. These plans frequently consist of extra benefits along with dental, vision, and prescription drug insurance, which traditional Medicare does not now cowl.

An example is a retired person paying $30 per month for a Medicare benefit plan that covers number one care visits, clinic remains, and medicinal drugs with minimal copays. Many plans additionally cap out-of-pocket prices, imparting economic predictability for seniors on fixed earning.

8. International alternatives: low-priced Plans overseas

For expatriates or retirees living abroad, international health insurance plans often offer robust coverage at decrease charges in comparison to U.S.-based options. In international locations like Thailand or Mexico, comprehensive non-public medical insurance can feel as low as $a hundred in a month.

For instance, a digital nomad in Mexico may select a plan masking ordinary test-ups, expert visits, and emergency care at top rate healthcare facilities for a fraction of the cost of similar U.S. Plans. Those options demonstrate that affordability is not always restricted by borders.

9. Regularly asked questions about affordable health insurance

Navigating the world of less expensive health insurance can be overwhelming, especially with the myriad of alternatives and policies. To simplify the procedure, here are distinctive solutions to a number of the maxima often asked questions on affordable health insurance. These insights will help you make knowledgeable selections for yourself and your circle of relatives.

What’s low-priced medical health insurance?

Less expensive medical insurance refers to coverage that offers critical fitness blessings at a fee inside the financial attain of individuals or households. It is designed to reduce the economic burden of clinical prices, ensuring entry to quality healthcare without straining your price range. Low cost plans often encompass preventive offerings, hospitalization, prescription medicines, and emergency care.

Subtopic: authorities programs and Subsidies

Authorities’ tasks like Medicaid and the kid’s health insurance program (CHIP) provide less expensive coverage for low-income people. Moreover, subsidies underneath the low-cost Care Act (ACA) help center-income households lower their month-to-month rates and out-of-pocket fees.

Who Qualifies for Subsidies under the ACA?

Under the ACA, subsidies are to be had for individuals and households whose income falls among a hundred% and four hundred% of the federal poverty degree (FPL). The subsidies, or top rate tax credits, are calculated based totally on earnings, household length, and the fee of plans on your place.

Subtopic: information profits Limits

The income limits are regulated annually based on inflation. In case your earnings are barely above the brink, you may still qualify for confined assistance, particularly if you have excessive scientific prices.

What are the key advantages of low-cost medical insurance?

Less expensive medical health insurance provides several blessings, which include:

1. Get entry to to Preventive Care: Annual check-ups, immunizations, and screenings are regularly completely protected.

2. Safety in opposition to excessive scientific fees: Caps on out-of-pocket maximums prevent monetary destruction in case of essential fitness activities.

3.intellectual health services: Many plans now include intellectual fitness and substance abuse remedy, which can be critical for holistic nicely-being.

Subtopic: comparing plans for better blessings

Low-cost plans vary in terms of coverage. Evaluating blessings which include co-will pay, deductibles, and provider networks allow you to select the satisfactory alternative for your desires.

Can I get low-cost medical health insurance without a task?

Sure, unemployed people can get entry to inexpensive medical insurance through marketplaces or government applications like Medicaid. Additionally, COBRA allows individuals to retain organization-sponsored coverage for a constrained period after job loss, though it can be pricey.

Subtopic: short-time period Plans for Transitional intervals

For the ones among jobs, brief-time period medical health insurance plans may also provide a transient solution. While not as comprehensive as ACA-compliant plans, they provide simple insurance to bridge gaps.

How can I lower my medical insurance charges?

Lowering medical health insurance fees calls for careful planning and consciousness of to be had options:

– keep around: Evaluate plans through marketplaces to find the satisfactory stability of fee and coverage.

– Select better Deductibles: Choosing a better deductible can lower month-to-month premiums, though this will increase out-of-pocket expenses for care.

– Utilize Preventive offerings: Taking gain of unfastened preventive services can reduce long-time period healthcare charges through catching troubles early.

Subtopic: fitness savings bills (HSAs)

In case you select an excessive-deductible fitness plan (HDHP), you may open an HSA to keep pre-tax dollars for medical prices, similarly lowering prices.

Is inexpensive medical health insurance the same as reasonably-priced insurance?

Now, not always. Even as “reasonably-priced” coverage may have low rates, it might lack comprehensive coverage, resulting in higher costs during medical emergencies. Low-priced medical health insurance, on the other hand, strikes a stability among price and benefits, making sure of protection without needless fees.

Subtopic: The importance of comprehensive coverage

Cheap plans regularly exclude critical benefits or have restricted networks that can cause surprising costs. Usually, the summary of benefits to make sure the plan meets your wishes.

What occurs If I do not Have medical insurance?

While the federal penalty for being uninsured under the ACA now does not apply, going without insurance can lead to economic dangers. Scientific emergencies can result in enormous out-of-pocket fees.

Subtopic: nation-unique penalties

A few states, like California and Massachusetts, still impose consequences for no longer having coverage. Experiencing your nation’s legal guidelines is critical to keep away from fines.

How am I able to locate low-priced medical health insurance?

Start with the aid of journeying your kingdom’s medical health insurance marketplace or healthcare. Gov to explore to have plans. Brokers and insurance marketers can also assist in identifying options tailored to your wishes.

Subtopic: community resources and assistance

Nonprofits and community fitness groups regularly provide steerage and even economic assistance for individuals suffering to discover less expensive coverage.

10. Conclusion: Taking manage of Your fitness coverage

Affordable medical health insurance is within reach if you understand where in to look and the way to navigate the alternatives. Whether via organization-backed plans, authorities packages, or the ACA marketplace, the secret is to examine, research, and pick accurately. Don’t forget, your health is valuable, and securing less costly insurance is an investment in your destiny well-being.